Economic Figures

Some of the statistic we use are from public sources, but others are original pieces of analysis compiled for us by Dr Andrew Johnston at Sheffield Business School.

The 2018 Tech Nation Report estimated the total number of people engaged in digital technology roles in the Sheffield and Rotherham tech cluster at 22,034. This is people who work in companies within those two local authority areas, not people who are resident there. The vast majority of these people work in companies that are not classified as digital technology firms, which shows how the wider economy is digitising, how broad the opportunities are for people with tech skills, and also hints at the contention on those skills as they are in demand by an ever growing portion of the economy.

We estimate that there are roughly 1,000 digital technology firms operating within Sheffield’s Local Authority area. Classification is very difficult as there is no specific definition or coding for what constitutes a digital technology company. The currently accepted way of measuring this uses a ‘basket’ of Standard Industry Classification codes developed by the Department for Digital, Culture, Media and Sport (DCMS), and you can read about this method and it’s ongoing history in the government’s “DCMS Sector Economic Estimates Methodology” document (it’s genuinely an interesting read if you’re into this stuff ?)

This statistic is an estimate of the proportion of the total number of digital tech firms in the Sheffield City Region that those roughly 1,000 firms in Sheffield represent. Or in other words, of the total number of tech firms in the region, Sheffield is home to about 38% of them. Again this is hard to assess accurately, for the reasons given already, but it does certainly indicate that there’s much more to the region’s tech sector than just Sheffield. How these firms are distributed across the region would be a good thing to look at in future editions.

We estimate that there are roughly 8,000 people working in the roughly 1,000 firms in Sheffield, or there were in 2017 anyway. Again it is difficult to get solid figures on this as types of employment vary greatly (how many self-employed contractors work in tech firms?) and not all companies are required to report their headcount of course. This also represents all kinds of employment, not just roles which are classed as relating to digital technology. Still, it’s Sheffield Business School’s current best estimate and provides us with a good baseline. I’m sure we’ll revisit this in future editions, and I would especially like to relate it to salary and GVA distributions to see how much the sector is really worth to the local economy, as I don’t think the number of jobs tells the whole story.

This figure shows the number of people employed in tech companies in Sheffield as a proportion of people employed in tech firms across the whole City Region. Interestingly, this is a much higher proportion than the proportion of tech companies that are in Sheffield vs the wider region, which means that Sheffield is home to larger firms, on average. Again, mapping this in more detail to show the relative sizes would be fascinating thing to do (if anyone has some research money or graduate students to throw at the question, hint, hint!)

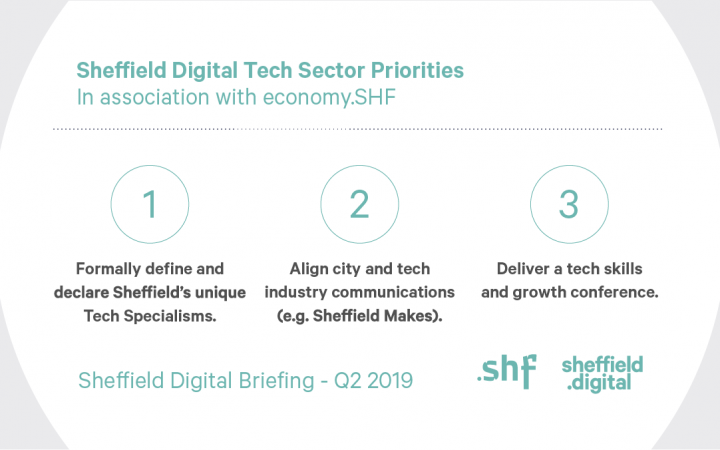

Digital Tech Sector Priorities

In addition to compiling economic statistics, we also polled people who attend the regular economy.SHF meeting and asked them what they thought the three most pressing things are to address in the local digital economy.

economy.SHF is an open meeting for people and organisations interested and engaged in the digital economy in Sheffield, and is chaired by Sam Chapman from the Floow and facilitated by Sarah Lowy-Jones from Growth Sheffield, with our support. You can read the minutes from all the previous meetings in this Trello board.

Here’s what the poll results showed:

- Formally define and declare Sheffield’s unique Tech Specialisms.

This is the item we have attempted to address in this first edition of the Quarterly Briefing, following many discussions with local employers and government agencies. The current thinking is that there are several important horizontal capabilities, such as software engineering, data analytics, simulation, AI (especially NLP and machine vision), cyber, visualisation, etc. and four major vertical application areas: EdTech, Creative Tech, Movement Tech and Advanced Manufacturing Tech.

We explore this in more detail in the ‘focus’ section of the briefing, and there is much work still to be done to understand this and bring more coherence to it if possible, and we would love to hear people’s opinions about it. - Align city and tech industry communications.

This is about making sure our voice is heard when the city and the region communicate with the outside world, in their marketing, their engagements and at major trade fairs and conferences. The city’s Brand Partnership, which is the group responsible for crafting Sheffield’s brand is committing to a new campaign called “Sheffield Makes”, and it’s very important that the tech industry is part of this messaging, and that it is represented accurately. This is also why this quarterly briefing is so important – it’s not just about getting the message out to people outside Sheffield, but also to provide other people within Sheffield with good narratives and an understanding of what the local tech industry is famous for. - Deliver a Tech Skills and Growth Conference.

There is now a lot more going on in Sheffield and the wider region around developing digital skills and starting and growing new tech firms – for example with Kollider, Cooper Project, Twinkl Hive and Sheffield Hallam iLab, we now have at least four permanent accelerators operating in the city centre. It would be great to bring all of these things together with investors, advisors and the local property community to run a conference specifically around developing new talent and firms.

This article was published in the 2019 Q2 Quarterly Briefing. For the rest of this publication, and others in the series please visit the Sheffield Digital Ecosystem Update page.